Factor

Mezzanine lending was poised to possess a massive year, particularly in the actual property sector, since senior lending will continue to sluggish in the middle of financial uncertainty and you can decreasing asset philosophy. Elevated rates enjoys reduced a home philosophy because of the as often since twenty five%, and a general sense of economic suspicion has some elderly loan providers sat on the subs bench while some somewhat tense their lending criteria. step one Predicated on J.P. Morgan, financing origination regularity has actually stopped by roughly fifty% away from just last year. dos At the same time, a projected $1.dos trillion from fund are prepared to help you mature within the 2024 and you may 2025, and you will current quantities of senior financing is ingest merely a fraction of this regularity. step 3 Of a lot newest consumers fall into otherwise into verge off a capital shortfall. And potential buyers try impact the pain sensation also. Senior maximum financing-to-worthy of rates has actually dropped to help you 55% otherwise straight down, making of a lot manage-feel consumers having a life threatening gap about financing heap.

Mezzanine credit fulfills one gap. The name derives on architectural title for an intermediate tale regarding a creating organized anywhere between a few number 1 tales. Such as for example its architectural equivalent, good mezzanine financing is throughout the financial support build anywhere between equity and you may older obligations. Since pit anywhere between collateral and you may elder debt expands, the demand for mezzanine financing expands. Economy requirements establish an alternate chance of mezzanine lenders. When you find yourself mezzanine lending involves greater risk than simply senior credit, the risk is lessened given that dollars moves and other working requirements generally are still strong. The newest lowering of a residential property opinions could have been passionate principally of the high interest rates, maybe not reduced principles. 4 Thus, in the course of expanding interest in subordinate capital, mezzanine loan providers is also bring premium rates while you are enjoying the shelter out-of sooner sound equity. 5

Investment trusts (REITs) are among the markets professionals organized to get to know the fresh new expanding consult to own mezzanine credit. Although many REITs run a home security, of a lot spend money on home-relevant obligations like old-fashioned mortgages and mezzanine funds. To own tech factors, but not, REITs commonly a natural complement the newest mezzanine credit place. The principles and guidelines one to regulate REITs do not expressly contemplate mezzanine lending, and also the newest suggestions regarding Irs (IRS) was at odds which have popular mezzanine credit strategies in several extremely important respects. Which have need for mezzanine money on the rise, the new Internal revenue service possess a chance to assist prevent a funds crisis of the upgrading its REIT mezzanine lending pointers, and thus unlocking a much-requisite way to obtain more funding.

(a) brings a short primer into mezzanine lending; (b) summarizes the existing information regarding the Internal revenue service away from REITs while the mezzanine lenders; and (c) talks about advised standing to the present Internal revenue service recommendations.

Mezzanine Financing

Mezzanine credit is a particular kind of under otherwise 2nd-lien funding. Traditional next mortgages fell of like from the wake from this new 2008 financial crisis, whenever each other loan providers and you can consumers became all too alert to their disadvantages and you can difficulties, and you may mezzanine financing emerged once the well-known replacement. The fresh defining difference between traditional next mortgages and you can progressive mezzanine funds is founded on the type of your own guarantee. A second financial are safeguarded by the a good lien about the subject a residential property. Another home loan company believes to help you under the lien compared to that of one’s first mortgage lender pursuant to a keen intercreditor contract, and so the first mortgage lender becomes paid down till the 2nd mortgage lender. Thus, one another loan providers express a similar collateral and contractually describe the new details of the relationships.

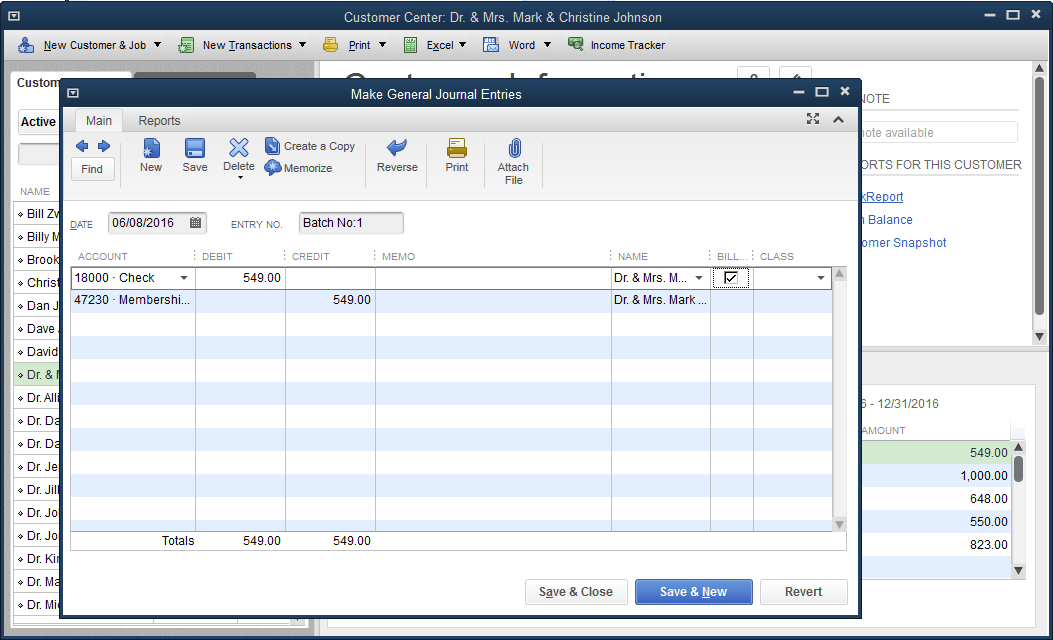

Mezzanine fund, additionally, are usually shielded by the a vow of your own guarantee appeal for the new organization one to has the topic home. 6 The senior lender takes a great lien directly on the niche a house, due to the fact mezzanine lender’s lien is one top taken from the fresh new a property about organizational framework. A simple mezzanine mortgage design seems something similar to it: