To keep approximately within the rule, multiple that annual shape so you can approximate in the a 3rd of one’s money – this means in order to comfortably manage good $350K house, you might should make around $ninety,000

- Money to cover a great $350K house

- Deciding points

- Sit the course

The latest average family sales rates by September is $394,three hundred, according to the Federal Connection from Realtors. But average function 50 % of sold for much more, and you will half for less – there are lots of house within the nation which might be offering for about $350,000.

How much cash want to secure to pay for a good home that is $350,000, even in the event? That may depend on a good amount of products, including the quantity of the down-payment in addition to interest rate of your own home loan. This is how to find out the cash needed for good $350K household.

Money to pay for a $350K family

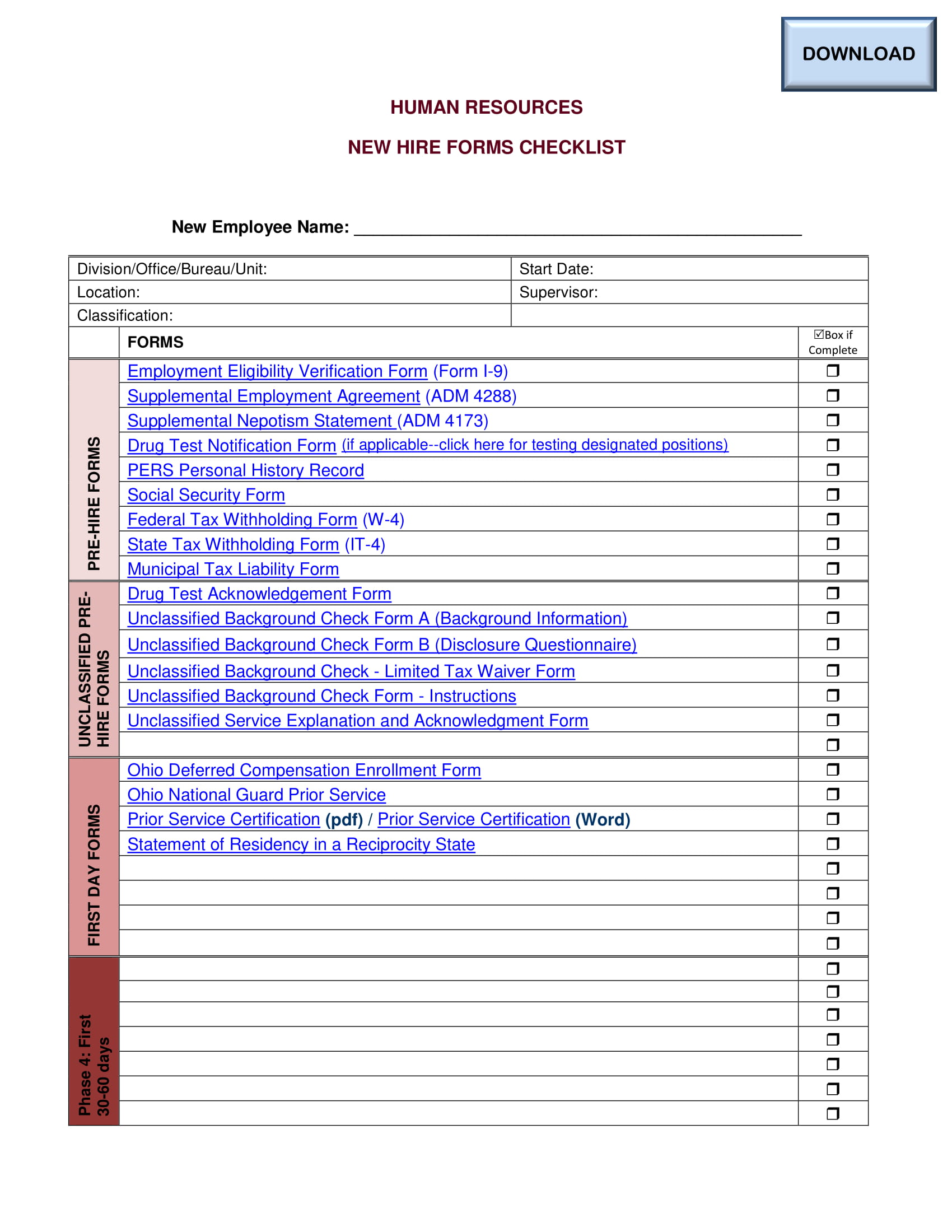

To find out how much you will want to secure getting a great $350,000 house pick, start by the newest signal. Which rule says that you shouldn’t save money than twenty-eight percent https://paydayloanalabama.com/pine-ridge/ of your own terrible monthly earnings on the housing can cost you, and you cannot save money than 36 % to the all of the of your financial obligation joint, also housing.

Bankrate’s mortgage calculator helps you work out how a good $350,000 purchase breaks down. Of course a 20 percent down-payment to the a 30-12 months financial at the an effective eight.5 percent interest rate, the newest month-to-month dominating and you may interest payments arrive at $step one,957. Don’t forget to are the fees that can vary according to where you happen to live, eg assets fees, home insurance and you can potential HOA dues. Let’s bullet one $step one,957 to $dos,five-hundred so you can take into account those individuals.

Multiply that payment per month from $2,five-hundred of the twelve and you’ve got a yearly construction expenses out of $31,000. (Although not, remember that so it formula doesn’t come with your deposit and you will closing costs, that are paid back upfront.)

Once the $350,000 try beneath the federal average household rates, your options could be some way more minimal than simply they’d getting within a top price. However, where you’re looking to buy helps make an impact here: Your budget will go such next in a number of areas as opposed to others. For-instance, new median house rates inside the Houston is actually next to their target rate in the $328,000 in Sep, centered on Redfin study. For the Hillcrest, even in the event, in which it actually was well over $900,000, you simply will not get almost as much for your currency.

To acquire property is actually a costly function, and there is much significantly more to adopt than simply the brand new house’s listing rate. And your annual money, listed here are additional factors you to definitely impact exactly how much home you can afford:

To stay roughly inside the signal, triple that annual shape so you can calculate about a 3rd of one’s money – this means so you can conveniently pay for a beneficial $350K home, you would need to make doing $90,000

- Credit rating: Increased credit history can help you be eligible for a reduced notice rate readily available. Actually a tiny difference in rates could save you thousands of cash along the lifetime of your home mortgage.

- Downpayment: A 20 percent downpayment is old-fashioned, but some home loan issues don’t need you to put down one much. Although not, more you can establish initial, the low your own monthly premiums could well be, and 20% will assist you to stop spending for private mortgage insurance coverage.

- Debt-to-money ratio: Your own DTI is how far you owe in debt in relatives to help you how much cash you earn, shown since the a portion (imagine the next amount in that code). The low their DTI, a lot more likely loan providers would be to agree your to own an effective mortgage.

- Loan-to-worth ratio: Also, the LTV try a measure of the loan amount in relation to help you how much cash the home is really worth. All the way down is even best for this metric, on the sight off a lender.