One of several latest and more than promising kinds of help is this new Advance payment To the Equity Work out-of 2021, and this is known as the $25K basic-time homebuyer give. Advance payment guidelines or other homes gives provide advanced level options so you’re able to very first-time homeowners to split towards real estate market. An average very first-big date consumer uses ages saving up to own a downpayment. This type of programs are present and also make homeownership far more open to a wider people.

This new Advance payment To the Equity Work is very the fresh new, so many prospective candidates are during the early grade off studying the fresh grant. For those who meet the requirements, whether or not, this might be just the right chance to safer federal recommendations when you find yourself making your own downpayment and you may as a citizen towards basic big date. Listed here is everything you need to realize about brand new $25K first-date homebuyer offer.

What’s the $25K very first-time homebuyer grant?

The newest Deposit For the Equity Act was a statement that was lead inside the Congress inside the 2021 to assist disadvantaged homeowners use the first procedures for the homeownership. The give gives prospective buyers which have as much as $twenty-five,000 inside the advance payment direction while they ready yourself to acquire their basic house.

The objective of this bill will be to generate homeownership far more accessible to have low-money if not disadvantaged some one and you can family members along side All of us. People that would getting very first-age bracket people be eligible for $20,000 into the guidelines, and an additional $5,000 can be acquired to possess buyers who will be noticed socially otherwise financially disadvantaged.

The very best benefit of the newest $25K very first-date homebuyer give is the fact that resource are provided in bucks at the time of closing instead of inside the tax recovery. Even though many other styles away from guidelines getting homebuyers are available toward this new tax code, the brand new $twenty five,000 basic-day homebuyer program can be obtained when you close to your house. You don’t have to cut back the cash assured you to definitely you can recover the expenses when you file your own fees. When you are acknowledged to the offer, you’re going to get the assistance if it is really expected.

The Deposit On the Guarantee Work are put in the Congress in 2021. not, this has not even come passed with the law. The bill remains becoming amended and you can argued on the federal regulators, so home buyers don’t already found down payment advice through this system. Although not, the continuing future of the bill is encouraging, and lots of legislators and real estate masters is actually optimistic one first-date homeowners will undoubtedly be able to benefit from this package.

Qualifying into the $25K earliest-date homebuyer offer

As the $25K earliest-go out homebuyer costs currently can be acquired, money is reserved to own very first-big date residents who see certain income qualifications. Consumers should have an income out-of 120% otherwise lower than new median income in the area, so that your earnings should be average otherwise below average to have your location. In the a top pricing-of-dining area, although, customers get meet the requirements if they secure to 180% of your median money in your neighborhood.

The money are also reserved getting first-generation customers. You might qualify for this method in the event the parents or guardians have never bought a house in america. Once the money possess such a strong generational parts that’s therefore closely linked to homeownership, the fresh new system exists to help people improve their own economic coming and the future of their students from the breaking on the housing market.

To keep eligible to the applying, you ought to live-in your house for at least five years. For those who sell the house fundamentally, you will need to repay area otherwise every financing. not, if for example the profit from the fresh new income are below their repayment amount, you’re not expected to pay it off.

How to get the new $25K first-big date homebuyer grant

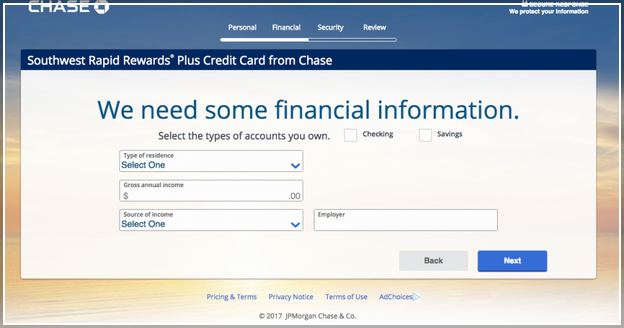

So far, the latest $25K having basic-go out homeowners program is actually a statement who may have perhaps not passed on law. Put simply, you simply can’t yet sign up for the fresh grant. In case the system does violation, both you and your mortgage lender are working to each other to try to get the program. The lender will fill in the application form and you may plan the new funding very your money is available as you close.

The newest $15K taxation borrowing from the bank is the same federal system to simply help property owners, but it is separate regarding the $25K first-go out homebuyer give. Which guidelines, known as the Basic-time Homebuyer Operate regarding 2021, gives a $fifteen,000 taxation credit in order to earliest-day customers whom fulfill specific certification.

Unlike the fresh new $25K so you’re able to earliest-go out homebuyers’ system, brand new tax borrowing actually available at the new closing desk. Possible still need to save your self for your downpayment, you could receive region or almost everything when you document their fees the second season.

Solution casing has

If you are hoping to pick property in the near future, you will possibly not need certainly to wait for $25K first-go out homebuyer expenses to pass through toward law. Therefore, there are many federal construction grants and you may recommendations applications available you to definitely you can qualify for.

FHA funds should be an effective option for very first-day customers because of their low down payment criteria. Although this system doesn’t offer resource, the all the way Broomtown loans down hindrance to entryway does make it easier for the fresh new people to track down home financing. Va loans are ideal for qualifying some body because they wanted zero down-payment.

The new Agencies out of Homes and you can Urban Innovation offers numerous programs to have first-big date customers, also. Such as, its Good-neighbor Nearby program facilitate coaches and very first responders purchase homes inside certain revitalization components at the a good 50% discount.

Purchasing your first residence is a primary milestone, also it can simply take many years to reach on your own. To set oneself upwards for achievement, you ought to speak about all you’ll be able to down-payment guidelines option that you you’ll be eligible for. Federal, condition, and you may local programs aim to assist consumers go into the real estate market, and that benefits the private homeowners and the community as an effective entire. You can consult a home loan specialist for additional information on the fresh apps that will make it easier to achieve homeownership.