Is a table of one’s top Virtual assistant loan providers online personal loans no credit Wyoming from the frequency as well as their advertised minimal credit score getting good Va loan. You might after that contrast by visiting all of our webpage towards most readily useful Va debt collectors.

Va Mortgage Fico scores 2023

As the Virtual assistant financing borrowing from the bank conditions try less than old-fashioned money, Veterans with many fico scores use Va fund. Let me reveal a chart appearing the fresh new portion of acknowledged Virtual assistant Money by Credit rating from inside the 2023.

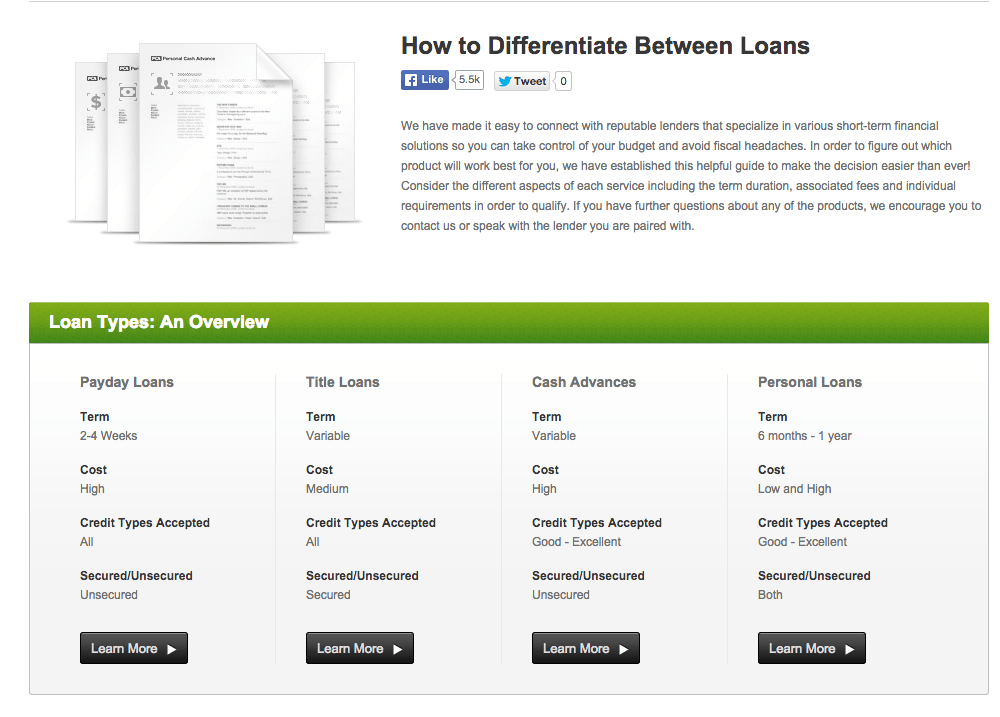

Va Mortgage Borrowing from the bank Criteria against. Almost every other Home loan Alternatives

To raised recognize how Virtual assistant loan borrowing requirements compare with other home loan options, here is a dining table that measures up the financing score minimums out of all major mortgage points.

Activities that affect Their Virtual assistant Mortgage

Fico scores aren’t the only factor deciding if or not you meet the requirements to own a great Virtual assistant mortgage. Understanding the things that affect your own Va financing is vital having Experts looking to be property owners.

Debt-to-Earnings Ratio (DTI)

The debt-to-money (DTI) proportion is another essential component that lenders envision whenever evaluating your application for the loan. Your own DTI is short for this new part of the newest monthly gross income one would go to paying their repaired costs for example debts, taxes, charge, and you may insurance fees.

Lenders make use of your DTI ratio since an indicator of money move to see just what portion of your income would go to fixed will cost you. In general, lenders want to discover a great DTI proportion regarding 41% or faster having Va loans. Yet not, in some instances, you might still feel accepted that have a high DTI ratio if the you have compensating issues, such as for instance a high credit score otherwise extreme dollars supplies.

To calculate your DTI ratio, seem sensible all of your current monthly debt repayments, including credit card bills, vehicles repayments, or any other funds, and you may split one complete by your disgusting month-to-month income. Including, if your complete monthly financial obligation payments try $1,five-hundred plus disgusting monthly money was $5,000, your own DTI proportion could well be 29%.

Credit history

Lenders make use of your credit rating to confirm how good you have got treated credit prior to now. Even when earlier overall performance is not always an excellent predictor regarding future performance, it is a good product getting lenders.

A few previous blemishes may not perception your odds of delivering good Va Loan, and it is important to understand that present credit history offers more weight than simply old credit rating. For this reason, clearing up your credit score for some days before applying getting an alternative loan is better if you have got recent credit products. That have bad credit may also change the interest rates and fees associated with the a good Va loan, making it crucial to contrast possibilities.

Ideas on how to Replace your Credit rating

Delivering a Virtual assistant mortgage with poor credit is tricky, but it is perhaps not impossible. When you yourself have a reduced credit history, there are several steps you can take adjust they. Here are some resources:

What do I really do when the my Va application for the loan are refused?

- Request recommendations about financing administrator on the enhancing your recognition odds.

- Opinion your credit report when it comes to errors or discrepancies and argument them if necessary.

- Pay off any the debts and keep maintaining your own credit card balance reduced.

- Shell out the expense on time and get away from trying to get brand new credit profile.

- Build-up the savings to exhibit lenders that you will be financially responsible.

Yes, you can get a good Va financing having a 600 credit rating, but providing recognized could be harder, and you may have to pay increased interest and you can/otherwise bring a much bigger down payment. Loan providers will even believe other factors, just like your money, debt-to-income proportion, and you will a job history, whenever deciding the eligibility having a good Va mortgage. It is advisable to change your credit rating before you apply for a loan to increase your chances of recognition and you may safe most useful terminology.