Whenever applying for a mortgage in the Dallas, one of the first circumstances lenders often determine will be your borrowing from the bank score. It around three-fist count are a picture of the economic health and takes on a vital role inside the deciding the sorts of financial options available to you. A premier credit rating suggests that you control your expense sensibly, pay the bills timely, and they are less inclined to default toward fund. These types of functions leave you a stylish candidate to have loan providers. This article have a tendency to explore just how maintaining an effective credit history normally help you safe good mortgage prices and easier percentage terms and conditions, ensuring that you may make more of one’s newest Dallas mortgage market criteria.

Market Requirements

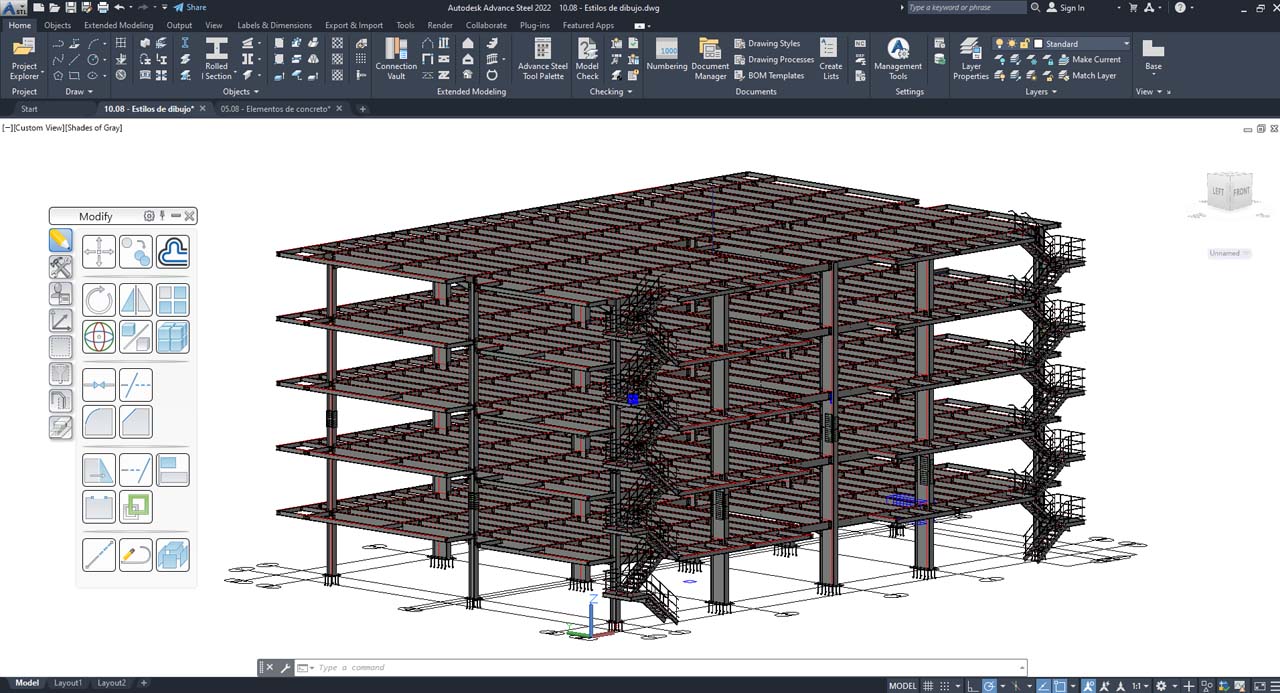

Currently, Dallas mortgage prices are having action. 30-12 months repaired home loan averaging doing six.938%, a good fifteen-year repaired around 6.084%, and a good 5-12 months variable-price mortgage (ARM) at the around seven.918%. Such prices was in fact popular upwards has just, concentrating on the importance of securing an increase easily once you discovered pre-recognition. Despite such rising costs, this new Dallas housing marketplace stays as good as escalating home values and you can a strict list, presenting one another demands and you may possibilities in markets.

Credit rating Criteria inside Tx

Inside the Colorado, especially in Dallas, most lenders lay minimal credit rating for antique funds at the 620, if you’re FHA loans shall be safeguarded having a credit score once the low given that 580. Gaining increased credit score can be somewhat improve your chances of choosing most useful rates of interest. This may sooner apply to their installment loan Magnolia NC month-to-month mortgage repayments and you will full financing pricing.

Having conventional loans, the average advance payment is just about 20%, but numerous choices give lower down payments. Such as, FHA funds require only an effective step 3.5% advance payment, and Virtual assistant fund offer an incredible advantage to eligible pros of the demanding no advance payment after all. This type of options create property so much more accessible, especially for very first-time buyers or people who have shorter available bucks for upfront will set you back.

Selecting the most appropriate Bank within the Dallas

Navigating the new Dallas financial landscaping can be more quick into help of local loan providers like the Tuttle Category, who’re better-acquainted the marketplace knowledge and certainly will help in optimizing your financial support choices. Including, the brand new Colorado Financial Borrowing Certificate (MCC) program offered owing to local lenders offer extreme tax recovery because of the enabling homebuyers so you can claim a credit to possess a fraction of its home loan notice. This work with can aid in reducing complete credit will cost you drastically. In addition, regional options form a very designed, efficient app process and aggressive rate offerings.

To explore exactly how your credit score make a difference their mortgage selection inside the Dallas and also to acquire far more understanding into the current market, think joining our totally free webinar. Here, you’ll get pro advice customized to your Dallas field, assisting you generate told conclusion regarding your home get. Sign in now and begin your go to homeownership with certainty, armed with suitable education and help.

Home loan Prices Credit Effect Dallas

Understanding how financial prices are determined is essential while appearing purchasing a house within the Dallas. This type of pricing depict the price of credit funds to invest in an excellent property and therefore are influenced by numerous financial products. Fundamentally, the borrowed funds price is a significant element you to definitely affects the entire price of your own home loan, dictating one another the monthly obligations and the long-label attention might shell out.

One of the main determinants of the financial price you be eligible for is the credit rating. A higher rating, typically a lot more than 740, can help you secure the best possible pricing, resulting in straight down monthly installments and possibly helping you save plenty over living of one’s loan. On the other hand, lower ratings can result in higher costs, hence develops their credit costs drastically. Having detailed some tips on boosting your mortgage standards, talk about this complete publication.