The newest drawn-out period of time setting all the way down monthly money to have consumers which you’ll if you don’t not be able to afford that loan

Lisa Montgomery, national director to possess consumer advocacy from the Resi, which gives a zero-deposit financial, believes you to definitely into the a perfect business all the homebuyers would save a deposit. But not, she says, no-deposit finance are helpful to own younger people which can’t afford so you can save your self in initial deposit while also spending book.

When you find yourself recognizing worries about larger funds within the an appearing interest rate environment, McCabe states the fresh incidence off non-payments is less one of St George’s no-put financial individuals than it is for those that have fundamental mortgage loans

“In today’s ecosystem, a great amount of basic home buyers are on their way right up just like the a significant buyers is actually looking to get from the markets,” she states.

He states the bank cash loans Rhode Island does even more inspections prior to granting a zero-deposit financing, adding you to borrowers are often people who have higher revenue who don’t possess in initial deposit conserved when they get the possessions needed.

“You need to know you can afford it along with understand you are not planning to get off your self small if the rates rise,” he says. And make certain you buy property with the possible to have gains.

In the event the idea of paying off a mortgage to own twenty five otherwise 3 decades musical bad adequate, is actually 50 years to have size.

GE Currency is probably the very first Australian financial supply household finance more than forty years rather than the usual twenty-five otherwise 31 ages as there are talk almost every other loan providers will abide by fit, maybe deciding to make the name half a century.

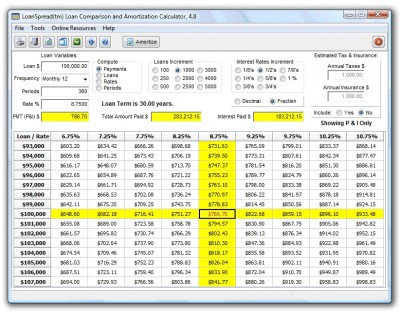

31 % rate of interest perform costs consumers $ 30 days over twenty five years, but simply $ more than forty years and you will $ more than 50, data from InfoChoice inform you. Continue reading “The newest drawn-out period of time setting all the way down monthly money to have consumers which you’ll if you don’t not be able to afford that loan” →