What does they suggest as an owner-builder?

Strengthening a property is actually a primary monetary starting, according to data away from Australian Bureau regarding Statistics (ABS), average price of constructing yet another cuatro-rooms household inside the 2020 try $320,000.

No wonder then a large number of potential domestic developers trying to save up to that-3rd of the design costs imagine managing the opportunity themselves. Whatsoever, it’s not necessary to contain the power to swing a hammer so you’re able to supervise a property construction, or so they feel.

Building a home once the a manager-creator comes to co-ordinating and you may overseeing the entire build processes, also controlling the some deals involved and getting responsibility for the defense of your own strengthening webpages.

Even though it is a difficult task, the brand new prize is actually pocketing the fresh margin you to a creator manage or even fees, can potentially reduce the total cost away from construction by anywhere between ten and you may thirty-five percent.

Trying to get an owner-builder enable on the net is surprisingly effortless, you could effortlessly be a builder within just occasions.

Just be in a position to co-ordinate and also their deals in-line in advance with the intention that just like the your doing others is ready to begin.

Whenever you are give-towards experience is not called for, world associations will apply for payday loan Amherst assist. The greater the project, the greater number of guidelines a manager-creator might require out of deals and possibly some one from a casing records.

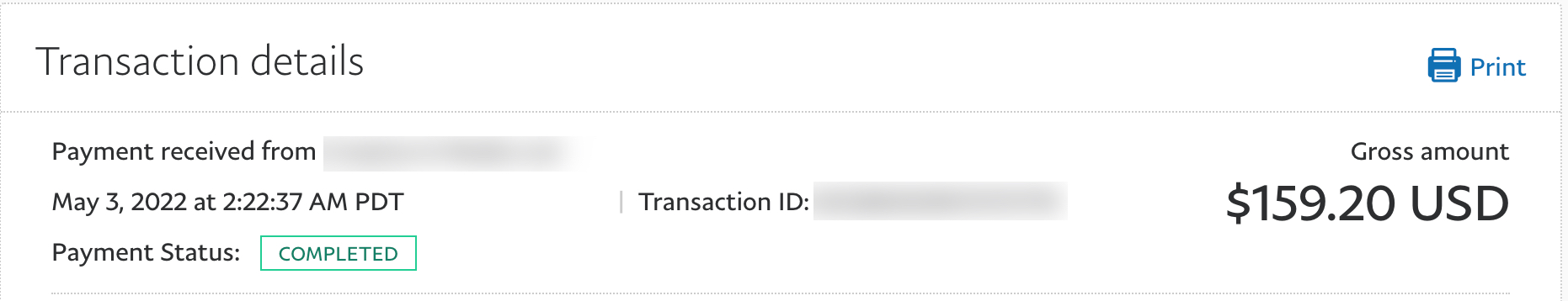

Take a look at exactly how your residence financing measures up

Really holder-designers are generally juggling work and you can controlling a setup, Very, until you may have a constant job or a checking account full of money, finance companies will most likely finance just up to 50 percent out of the development cost or 80 per cent of your land-value. Continue reading “What does they suggest as an owner-builder?” →