Is a table of one’s top Virtual assistant loan providers online personal loans no credit Wyoming from the frequency as well as their advertised minimal credit score getting good Va loan. You might after that contrast by visiting all of our webpage towards most readily useful Va debt collectors.

Va Mortgage Fico scores 2023

As the Virtual assistant financing borrowing from the bank conditions try less than old-fashioned money, Veterans with many fico scores use Va fund. Let me reveal a chart appearing the fresh new portion of acknowledged Virtual assistant Money by Credit rating from inside the 2023.

Va Mortgage Borrowing from the bank Criteria against. Almost every other Home loan Alternatives

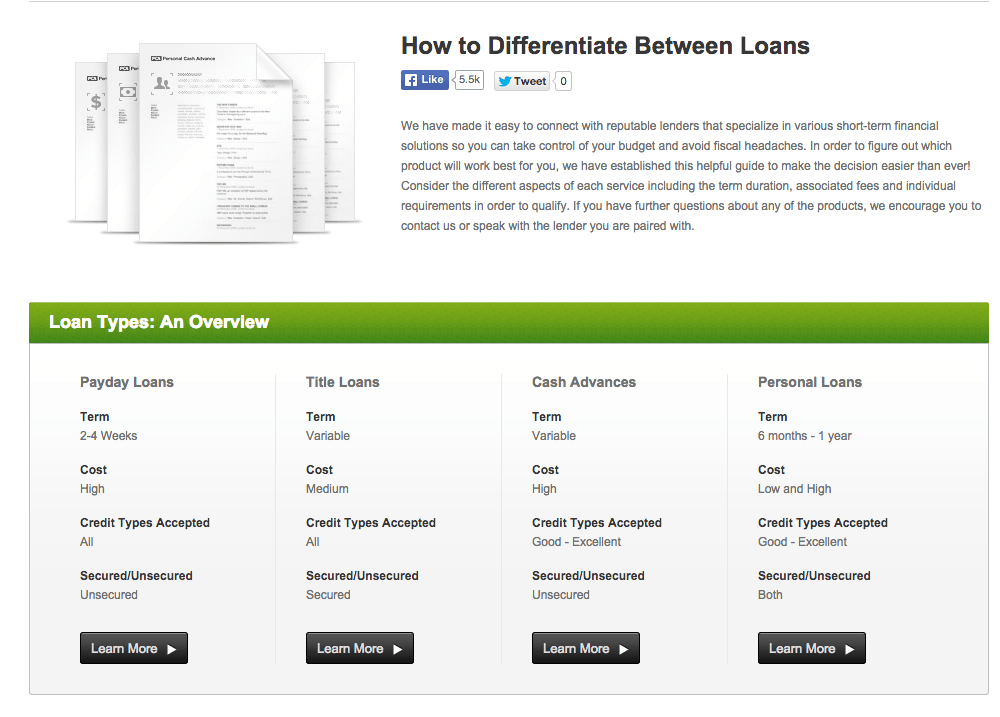

To raised recognize how Virtual assistant loan borrowing requirements compare with other home loan options, here is a dining table that measures up the financing score minimums out of all major mortgage points.

Activities that affect Their Virtual assistant Mortgage

Fico scores aren’t the only factor deciding if or not you meet the requirements to own a great Virtual assistant mortgage. Understanding the things that affect your own Va financing is vital having Experts looking to be property owners.

Debt-to-Earnings Ratio (DTI)

The debt-to-money (DTI) proportion is another essential component that lenders envision whenever evaluating your application for the loan. Your own DTI is short for this new part of the newest monthly gross income one would go to paying their repaired costs for example debts, taxes, charge, and you may insurance fees. Continue reading “Lowest Fico scores of top Virtual assistant Loan companies”