Are a primary-time homebuyer try an exciting amount of time in anyone’s life. But often it’s hard to share with where in actuality the excitement starts and you will brand new anxiety ends up.

The lending company paid down the remainder $40,000 out-of Tofeeq’s fund and she grabbed aside another loan with the home with the lending company to settle you to equilibrium

This is because since the a time putting because of your veins is actually truly related to putting some financial support off owning a home, rushing correct alongside it from the breakneck price is the uncertainty and you will stress that comes from the processes.

As well as the mixture of all the emotions and thoughts that are impressed when buying property on basic-time is very intoxicating to have Millennials and you will young very first-date homeowners.

Increasing rates, dwindling availableness, additionally the burden of things like extortionate student loan loans or wages that aren’t in keeping with the values away from homes during the hot places combined with unanticipated costs and you may charge make homebuying sense a great deal more daunting.

According to Federal Relationship away from Real estate agents one-third of all of the homebuyers for the 2018 was basic-day homeowners while the median ages of people first-go out individuals is thirty-two.

But there is a large number of some other routes getting earliest-day homeowners to go into this new housing industry and lots of of them paths are made to assist them to traverse this new both craggily roadway for the homeownership.

Such, considering Freddie Mac, one-last of all of the first-time homebuyers utilized a Oregon payday loans present or a loan from family unit members to buy the very first house if you find yourself an extra 10% gotten federal financial help.

Has just, the fresh new Providence Journal talked to numerous people who bought homes for the 1st time and you may recognized how they reached to acquire a house for the first time and outlined them because sort of selection to many other basic-big date homeowners to adopt.

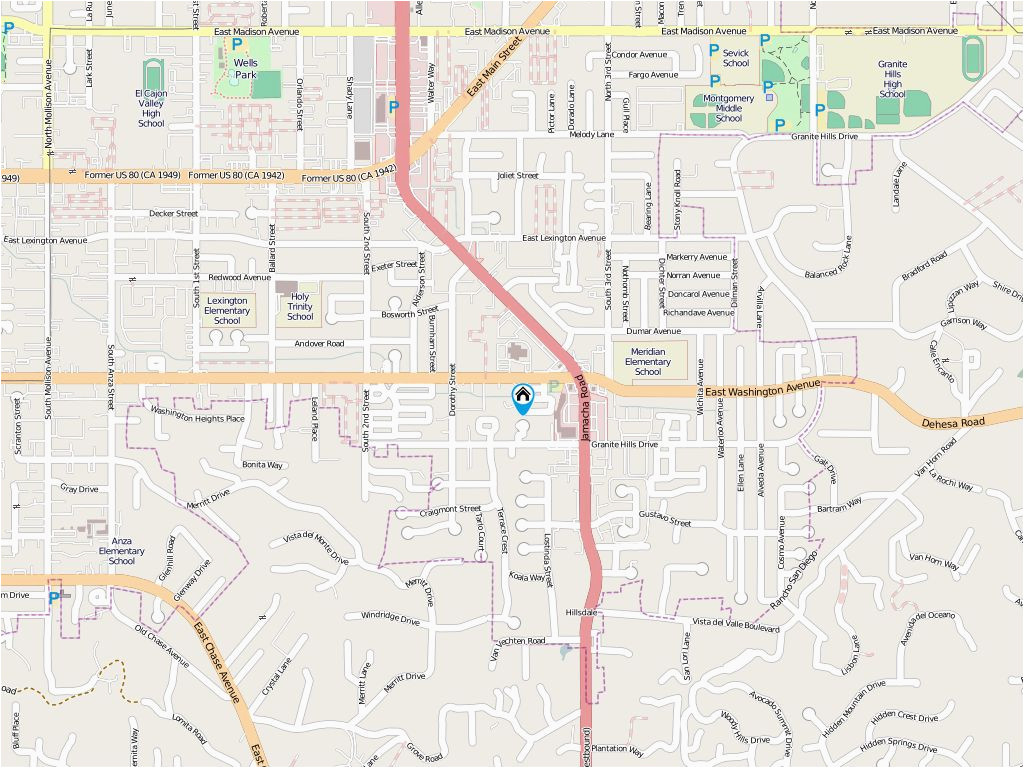

The storyline: New Fernandes’ have been protecting as much as purchase a property and weren’t quite ready to purchase, even so they arrive at worry once they spotted pricing hiking and you may mortgage costs rising on Fall out of 2018. Within a month, they produced an offer on an effective townhouse inside Leesburg, Va. To start with, planning to save enough getting a bigger deposit, these people were in the twelve percent at the time of the purchase. They are expenses a private home loan insurance (PMI), but that’s traditional for most financing that have a down-payment off lower than 20%. They used the extra money to do work with our house, as it are a little bit of a fixer higher. Therefore, it negotiated to your seller to pay for needed solutions (a unique hot-water heater, resealing window and you will an area on top) and so they used those funds because a cards to your closing costs to save the additional bucks for further home home improvements. Since they been able to put smaller off and negotiate for try to be performed into assets up until the income, capable have the current possessions appraised in the near future and can even possibly take away the PMI.

The storyline: Rija Tofeeq wasn’t sure if she along with her husband Sayed Shah should buy a home or pay off their unique education loan loans. These were coping with Tofeeq’s parents and you can she got $67,000 with debt and you can $50,000 inside offers. That’s when Rija got been aware of the latest which would allow their own to repay her student loan with a no-notice next mortgage if they used the to purchase a property. Shah stored off towards getting an alternative business in order to meet requirements. Tofeeq took from financing within her title. She repaid $27,000 out of their particular figuratively speaking and you can used an alternate $20,000 due to the fact good 5 % downpayment on a single-house inside Heaven. The big contract to have Tofeeq we have found that for as long as she resides in our home and you will pays off the mortgage at no desire for 5 age, the rest of the financing might be forgiven.

The storyline: Clauss relocated to Washington D.C. with her three youngsters into the 2016. Incapable of afford to purchase a property, she hired a basements flat, however, constantly got her attention to the award out of getting their home. Attempting to alive alongside where she worked in the Northwest Washington, value is a bona-fide thing. That’s whenever she used a couple of household customer applications to assist her enter into her very own home from the Fort Lincoln Playground people away from Northeast Arizona. Earliest, she inserted the fresh new District’s Inclusionary Zoning Program and that brings a lottery to offer fund in order to a qualified applicant to shop for an easily affordable domestic. The applying has many methods, plus earnings limits and a requirement when deciding to take kinds into the homebuyer degree. If you find yourself she waited to find out if she would smack the lotto, Clauss including eligible to a great $29,000 loan to support a down-payment even though D.C.’s Household Pick Assistance System. You to coupled with $2,000 she got protected on her behalf individual are brand new lynchpin getting her to help you safer her very own house after she obtained the latest inclusionary zoning lottery.

But not, these people were anxiety about placing all that money down and you can need to keep a number of the cash, so they really only place 5 per cent down having a normal mortgage aimed toward basic-big date homeowners

The storyline: Maria Lynard realized your best way she by yourself helps you to save currency purchasing a property would be to live with their particular moms and dads for a lengthy period to store the cash required for an advance payment. So, she did, and when she is happy to get a home, she talked in order to an agent exactly who clued their unique during the to homebuyer guidelines software when you look at the Virginia that are designed to assist first-go out homebuyers. Considering their particular updates while the a first-go out homebuyer and their own income, Lynard qualified for good Virginia Property Innovation Power give off $cuatro,000 to simply help shelter their own settlement costs. Which offer does not need to getting paid once the she got an enthusiastic on line homebuyer category. Due to this guidelines, she managed to place eight percent down on a beneficial $2 hundred,000 household which had been move-for the in a position.