Within publication

Whenever you are more 55, guarantee discharge enables you to unlock some of the really worth inside your home without having to promote up and move.

You are taking out a loan protected facing your house out-of an guarantee discharge merchant, that is following paid when you go towards the much time-title care or perish.

Studies about Equity Discharge Council shows that people utilized ?dos.6 million in the possessions wide range via security release items in 2023, once the amount of new clients using equity release rose so you’re able to 5,240 ranging from 12% higher than the prior quarter.

But not, taking out loans Woodland Park CO fully a security launch bundle is a huge choice and you will there are disadvantages to take on, you need think hard prior to going in the future.

What exactly is security discharge?

When you find yourself a homeowner old 55 or earlier, you might find your domestic-rich however, dollars-bad. Because of this you’ve got more worthiness fastened in your home than you do into the easily accessible cash and other property.

Security discharge is actually a method getting seniors to turn particular of the property value their property to your cash without having to disperse. It is essentially a specific sort of loan that is secure up against the possessions.

It is similar to a mortgage but you do not build constant, monthly costs. Rather, people interest you borrowed from is set in the loan and you can builds up over day. The loan is sooner or later paid off after you pass away or move into long-term worry.

Because of the way security discharge really works, the interest payments can cause the cost of the mortgage so you can balloon. Guarantee discharge is high priced compared to the remortgaging otherwise downsizing, which have pricing typically much higher than simply basic mortgage loans.

How much cash do you really acquire?

The maximum amount you can acquire is to 60% of your own worth of your property, according to the government’s Money Advice Services.

How much cash can use utilizes facts like your age therefore the value of your home. New percentage normally grows predicated on your age when you take aside the item.

- Your age

- How much you reside worth

- The state of your wellbeing

- You to dollars lump sum payment

- Less, typical payments

- A mixture of both

Collateral launch calculator

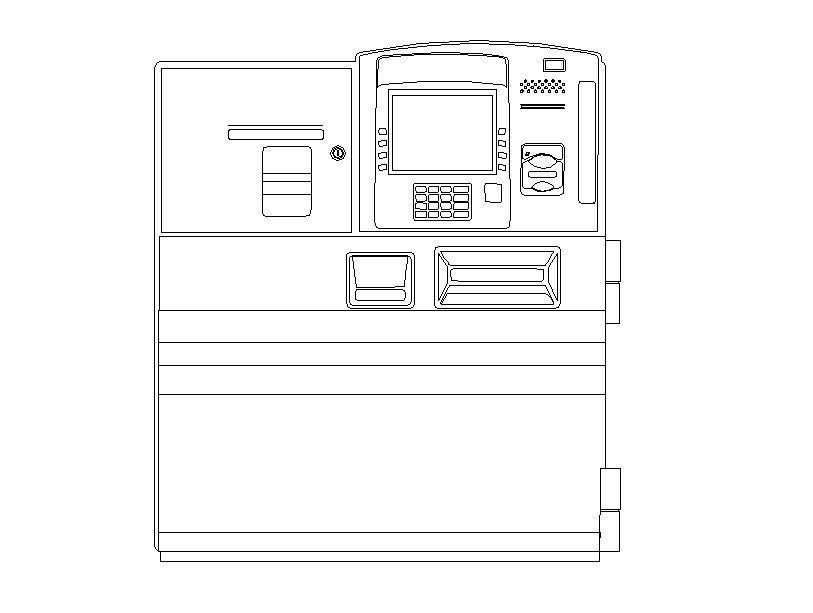

Utilize the 100 % free equity discharge calculator like the one to lower than to get a sense of how much cash you might use.

Exactly how provides interest changes influenced equity release money?

Decades away from rock bottom cost fuelled an equity launch increase, which have borrowers unlocking accurate documentation-breaking ?six.dos mil of money off their belongings within the 2022.

However, the level of cash released owing to guarantee release sank so you can ?2.six mil inside 2023, pursuing the several evident increases for the rates of interest. Which made the price of credit more costly making new balance due towards the security release agreements balloon quicker.

On the Lender out of England feet price dropping regarding 5.25% to help you 5% during the August, specific assume collateral launch rates will start to fall gradually.

Rachel Springall, a loans pro in the , said: Economic conditions, interest rates and you may industry balances all the gamble the area if this pertains to the new prices of lifestyle mortgage loans, given that loan providers must ensure it place its rates in-line due to their emotions so you can exposure.

The financial institution out-of The united kingdomt feet price slashed does determine market sentiment which can lead to the latest re-pricing off lives mortgage loans. not, loan providers might possibly be aware of people forecasts related the future expectations of great interest pricing that could cause them to think twice to shed pricing from the well known margins.

There’s also constant uncertainty around if or not property costs will get fall in the future. Although not, significantly less than rules implemented when you look at the 1991, things feature a no negative equity make certain, and thus brand new debtor cannot are obligated to pay over the significance of their property.