- Affordable: A home loan makes you pick a home you can n’t have were able to manage having bucks. Additionally, it enables you to pass on the cost of the house more than a very lengthened go out, it is therefore less costly.

- Taxation positives: Home owners will enjoy income tax deductions less than Section 80C and you will Point 24(b) of your own Income tax Operate, 1961, for the principal and you can desire reduced on their home loans.

- Pressed coupons: Since you would-be paying a predetermined EMI (Equated Monthly Instalment) having a home loan, it can help inside pushed savings which help your generate guarantee.

Downsides off Financial

- Long-name commitment: Lenders try much time-title commitments, generally comprising 15-thirty years. This is certainly a drawback if your factors changes therefore need to move or sell the home.

- Rates of interest: Home loans typically feature highest rates than other borrowing forms, making the overall cost out of borrowing from the bank higher priced.

- Danger of foreclosures: If you’re unable to create your financing payments, you chance losing your residence in order to property foreclosure.

- Tying up out of fund: Home financing ties right up a life threatening part of the coupons, limiting your capability to get almost every other options.

In relation to financing, it may be challenging to decide which particular is the best for your circumstances. A couple of prominent options are personal loans and you can mortgage brokers. If you find yourself both can supply you with the cash you need, he has high differences in terms of rates, cost terms and conditions, and the function of the borrowed funds.

Let’s mention the difference anywhere between private and lenders to assist you’ve decided which type is the best for your specific need.

Interest rate

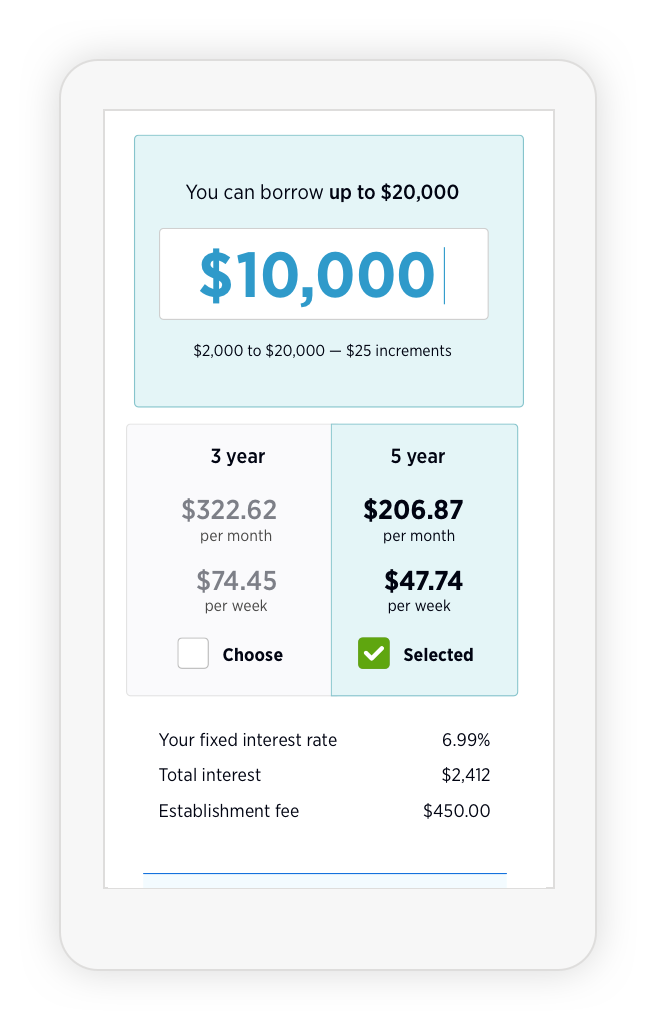

Interest is the percentage of the borrowed funds number a loan provider prices for credit money. It is generally speaking calculated while the a percentage of the dominant mortgage amount in fact it is billed over a period of date, such as for example a-year.

Unsecured loans tend to have a high interest rate than simply home loans since they are unsecured, meaning they don’t wanted any collateral, which makes them riskier for loan providers. Additionally, mortgage brokers are protected by purchased property, causing them to safer having lenders and resulting in all the way down focus costs.

Approved Amount borrowed

An approved loan amount ‘s the amount of money that a beneficial lender has actually provided to provide to help you a debtor. The lending company find https://clickcashadvance.com/personal-loans-in/ it count according to research by the borrower’s creditworthiness, income, and you may capacity to pay off the borrowed funds.

The mortgage matter private money could be lower than for lenders. Signature loans are used for various intentions, typically ranging from INR fifty,000 so you’re able to INR 40,00,000. Home loans, yet not, are clearly used in to buy otherwise reount ranges to INR ten crores.

Mortgage Period

Loan period is the big date more than and this financing is actually becoming reduced. Simple fact is that period between your loan disbursement big date plus the last payment go out and certainly will be mentioned into the months otherwise ages.

Personal loans often have a smaller tenure than simply home loans. Signature loans ranges from a single in order to 5 years, when you’re home loans ranges out-of fifteen so you can 30 years. This is because home financing can be used to find a great home, that’s an extended-name resource.

Equity

Collateral makes reference to a valuable asset you to definitely a debtor promises as the safety for a loan. It means the financial institution is also seize the latest collateral in case the debtor defaults towards the financing.

A personal bank loan was a personal bank loan and this doesn’t need collateral. Home financing is actually a secured loan where borrower’s possessions functions as guarantee. When your debtor defaults to the loan, the lender can foreclose towards the household.