And they weren’t familiar with people perception the Speed / Character mortgage have towards the coming deals of their property

Since a builder, whenever you are going to upload home knockers on the community, you may like to use products and you may items that create create just as much providers. The pace / Hero program works magically and you may offers such as for instance hot-cakes from inside the neighborhoods with entry-level listed house and you can people just who may n’t have prime borrowing from the bank. This is and additionally our very own ilies and Pros the help of its Va house mortgage advantage to purchase belongings are particularly often very first time domestic customers that simply don’t have prime borrowing from the bank.

I have a significant esteem toward conversion process community and also the tricky process of moving products or services away from point A toward part B. Seriously, everybody carries. Newborns initiate offering on the mom away from birth and you can perfect people enjoy by way of its teens as they ask for what they need and you can dispute its instance due to the fact young adults! I’ve a pretty obvious knowledge of exactly how this type of do it yourself sales scenarios utilizing Hero financing enjoy out in real time. It may be easy to generate focus plus smoother in order to sell positive points to a buyers in need whenever precisely the surface peak benefits try shown. Usually the cons are not stated, together with customer is on their unique to get the issues of the decision following product sales.

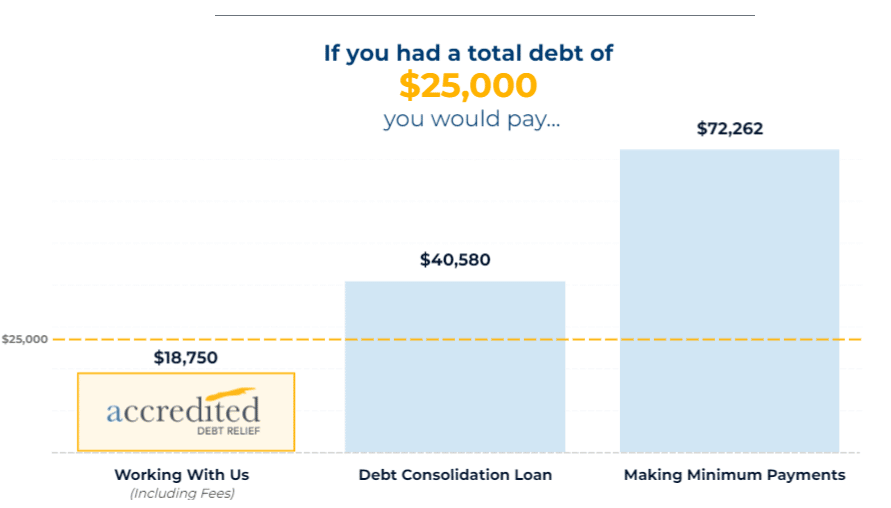

You will find some cons regarding the device as well as shipments program. Once the a homeowner that have a pace / Character mortgage connected to the house, you simply can’t incorporate old-fashioned capital so you can re-finance, and your people can’t utilize it to buy, which could stop a property business. Of numerous FHA & Virtual assistant loan providers have likewise then followed a comparable standing, declining applications into homes having a rate / Champion loan connected. And additionally those tell you stoppers, the attention cost and you may costs is actually seemingly highest, versus other covered lien mortgage products.

Nevertheless they didn’t spend the time for you examine financial support solutions for the its tactics. In addition, it considered that discover no impact after all to their possible opportunity to refinance.

As the chief shipment station having Champion fund is apparently as a result of builders, that it transformation system can lead to unexpected situations into homeowner. Reerica couples which have contactors while offering them private coupons and you can rebates, so that they can close a great deal more marketing, depending on the webpages. The company design is terrific, and that i applaud their achievement, however the homeowners should be produced familiar with the possibility consequences of the financing choice when you look at the conversion process procedure.

Into the transformation presentation, contractors are primarily emphasizing selling their providers and advantages of their renovations to your homeowners. Then portion of their demonstration, it spray this new sugar ahead, attempting to sell the characteristics or benefits associated with the fresh Champion loan, particularly easy being qualified and you can taxation advantages. On view off promoting benefits to the fresh new citizen, the fresh new builders was passed a terrific the newest product within their package. Selling a house upgrade endeavor just adopted smoother no borrowing from the bank requirements and you can improved tax masters! It’s not stunning that the contractors get off the latest downsides off product sales slope.

Unfortunately, during the 100% of your circumstances that we possess analyzed with my website subscribers, new individuals just weren’t it’s advised of all the long-name consequences out of accepting a speed / Hero mortgage to invest in their property improve ideas

Of a lot products that builders are offering complete a want inside a keen disaster, particularly hvac otherwise a different roof, maybe through to the winter months rainfall. Obviously, people are looking for a method to solve their emergency problem easily, rather than offering a great amount of planning so you can money choices. And generally speaking, this new citizen who means financial support in the place of paying bucks to possess an upkeep is the resident having a lower borrowing character. And also the exact same https://www.elitecashadvance.com/installment-loans-nj/ citizen with all the way down fico scores is about to end up being a far greater candidate to have a pace / Champion financing.