Strengthening a property is actually a primary monetary starting, according to data away from Australian Bureau regarding Statistics (ABS), average price of constructing yet another cuatro-rooms household inside the 2020 try $320,000.

No wonder then a large number of potential domestic developers trying to save up to that-3rd of the design costs imagine managing the opportunity themselves. Whatsoever, it’s not necessary to contain the power to swing a hammer so you’re able to supervise a property construction, or so they feel.

Building a home once the a manager-creator comes to co-ordinating and you may overseeing the entire build processes, also controlling the some deals involved and getting responsibility for the defense of your own strengthening webpages.

Even though it is a difficult task, the brand new prize is actually pocketing the fresh margin you to a creator manage or even fees, can potentially reduce the total cost away from construction by anywhere between ten and you may thirty-five percent.

Trying to get an owner-builder enable on the net is surprisingly effortless, you could effortlessly be a builder within just occasions.

Just be in a position to co-ordinate and also their deals in-line in advance with the intention that just like the your doing others is ready to begin.

Whenever you are give-towards experience is not called for, world associations will apply for payday loan Amherst assist. The greater the project, the greater number of guidelines a manager-creator might require out of deals and possibly some one from a casing records.

Take a look at exactly how your residence financing measures up

Really holder-designers are generally juggling work and you can controlling a setup, Very, until you may have a constant job or a checking account full of money, finance companies will most likely finance just up to 50 percent out of the development cost or 80 per cent of your land-value.

Investment just like the a proprietor builder ‘s the greatest demands. Most lenders commonly assess applications depending simply on the property value this new house additionally the cost of structure and then give 50 % associated with worthy of. Until you will be playing with loansHub, our lender committee gives around 80 percent to help you eligible individuals.

It can depend on your personal facts, for individuals who really works fulltime and cannot select a specialist deals individual assist, it’s best to leave it towards elite group.

Whereas if you find yourself a qualified trading individual with a good builder’s licence, so long as their proprietor creator venture will not feeling your primary earnings creating business, why should you save money because of the opportunity controlling.

So what does they mean as an owner-creator?

step 1. A manager-builder permit isn’t the identical to a great builder’s permit, however, owner-builders remain lawfully accountable for making certain all of the sub-builders is actually authorized and insured and available with a secure performing environment.

2. Overseeing setting more than simply ensuring that tradies turn-up on the time. Owner-designers need to make sure all the craftsmanship suits a certain standard, which is why building experience helps.

3. It’s much harder to own owner-builders so you’re able to safer a houses loan than for homeowners whom participate an authorized creator. Most financial institutions only will simply give around fifty percent out of the brand new land as well as design will cost you.

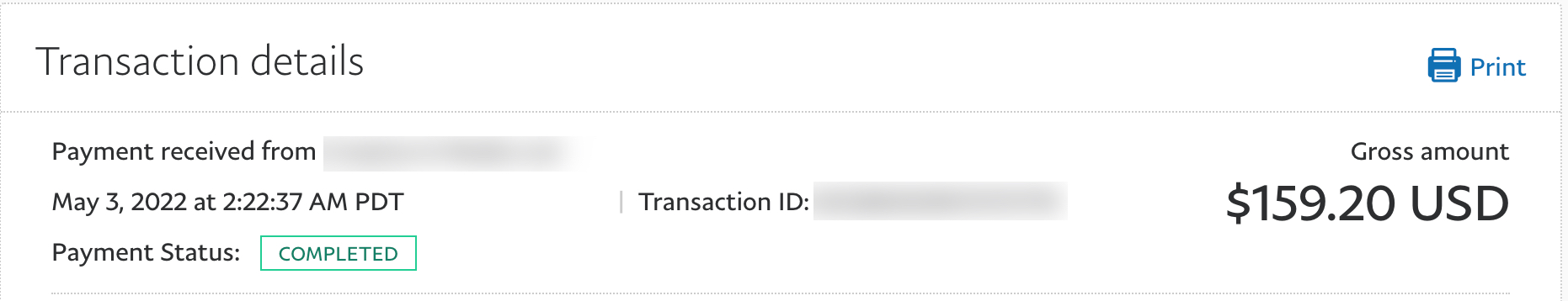

cuatro. Lenders normally generate improvements money as opposed to a lump sum payment, with every fee influenced by the project interacting with a particular phase. A familiar cash-flow pitfall are expenses funds on fittings and you may accessories hence cannot become installed during the early steps in design, and that aren’t examined by the bank’s valuer.

This may suggest money is actually withheld and design stalling if you don’t take care of a profit reserve to store new hammers moving whenever you are waiting towards the lender so you can disburse the latest phase allege.

5. Lenders won’t accept that loan just after structure provides commenced, or take on a partly completed family once the defense. Finances conservatively, never begin build before the financing is approved, and always manage a funds reserve to save the construction swinging if you are waiting around for the lender to draw on the loan.

Although you may be here, capture all of our mortgage shredder issue to see simply how much you can save money on your property and resource funds that with loansHub technical as your private mortgage movie director. Discover a discover why loansHub and what we would, follow this link.

This article does not comprise suggestions; members will be look for independent and you can customised the advice off a dependable agent that specialises inside the possessions, an income tax accountant and you can property design professional.